The Georgetown Chamber of Commerce is a strong advocate for the business community by providing advocacy, education, resources, and connections for our members. For more than 75 years, the Georgetown Chamber of Commerce has worked to build successful businesses and a vibrant economy. We’ve grown to become one of the largest chambers of commerce in Central Texas, and we welcome you to come grow with us.

Become a Member

Our members are devoted to business success, professional growth and providing an exceptional quality of life for those that live and work here. Explore our website, and you’ll see a community of outstanding business, civic, and community leaders who support each other and our local economy. Make the smart investment for your business and join the Georgetown Chamber today.

Get Connected with the Chamber

Business Before Hours

Join us May 3rd for our Business Before Hours with Varenna Lakeside. This casual event gives you an opportunity to connect with local businesses in our community.

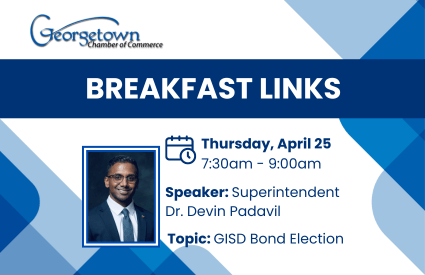

Breakfast Links

Join us April 25th at 7:30am at the Chamber for our Breakfast Links featuring GISD Superintendent Dr. Devin Padavil. Learn more about the 2024 Bond Proposals.

Annual Awards Banquet

Congratulations to our award winners! You are an outstanding group of leaders. Follow the link below to see the entire list of winners, along with pictures from the evening.

Upcoming Events

Explore Our Local Businesses

Georgetown is a city that is booming with energy & excitement. Explore our local businesses to learn more about our vibrant community.

Thank You to Our Allies

Platinum

Gold

Silver

ABC Home & Commercial Services I Amberlin Georgetown 55+ Apartment Community (Sparrow Living) I Ark Roofer LLC I Austin Community College District I AustinPX Pharmaceutics and Manufacturing I Bartlett Cocke General Contractors I Baylor Scott & White Medical Center Round Rock I Better Bookkeepers I Cadence Bank I Commercial National Bank I Corridor Title I First Texas Bank I GAF Energy I Georgetown Independent School District I Georgetown Living I Greystone Construction I Headwater Companies I HEB Food Stores I Hewlett Family of Dealerships I Hill Country Boat & RV Storage | Holt Cat I Home Depot I Independent Financial - Georgetown I Joe Bland Construction, LP I Mac Haik Ford Lincoln I Manitex I Maxwell, Locke & Ritter I Mercedes-Benz of Georgetown I Minuteman Press - Georgetown I Outlaws & Gypsies I R Bank I ServPro Restoration I Shop LC I Sneed Vine & Perry, PC I SouthStar Bank, S.S.B. I Staccato 2011 I Steger Bizzell Engineering, Inc. I Sun City Texas Community Association I Texas Electric Cooperatives I Texas Stars Limited Partnership I Truewood by Merrill I Truist I University Federal Credit Union I VeraBank, N.A. I Walmart Supercenter I Williamson County Sun